Industrial packaging products and services firm Greif has received the regulatory approval from the US Federal Trade Commission to close the $1.8bn acquisition of Caraustar Industries.

The commission has granted early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act regarding the transaction.

Both companies are now planning to complete the deal on 11 February as they have received the final regulatory approval.

In December, Greif signed a definitive agreement to acquire Caraustar from an affiliate of HIG Capital in a cash transaction of $1.8bn.

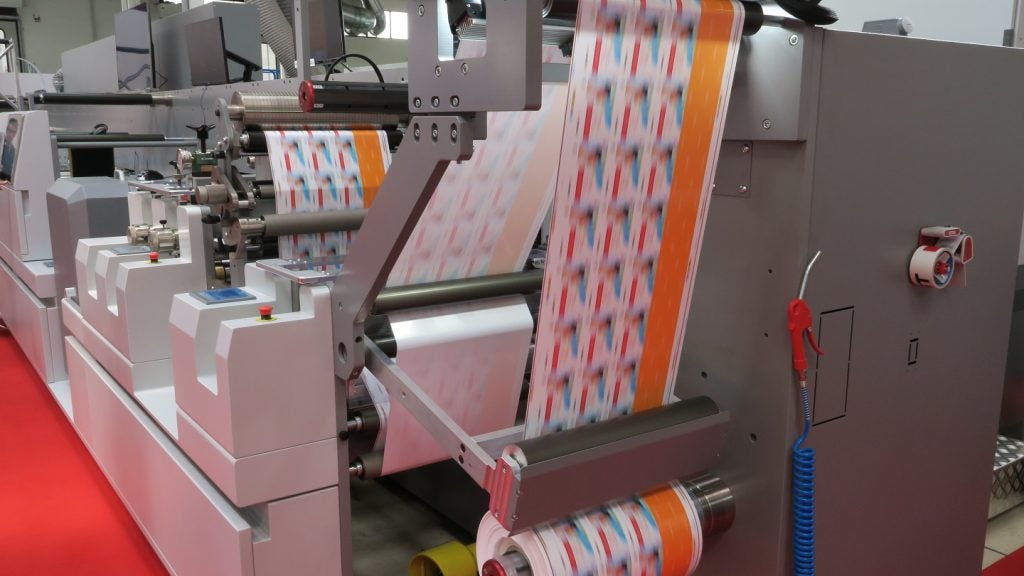

Based in Austell, Georgia, Caraustar produces uncoated recycled paperboard (URB) and coated recycled paperboard (CRB) for a range of applications such as tubes and cores, folding cartons, gypsum facing paper, as well as speciality paperboard products.

The company has four business lines, including Recycling Services, Mill Group, Industrial Products Group and Consumer Packaging. It currently operates more than 80 operating facilities across the US.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCommenting on the deal during the announcement, Greif president and CEO Pete Watson said: “Caraustar offers an exceptional strategic and cultural fit for Greif. Its complementary paper packaging and recycled fibre operations will drive significant free cash flow growth, improve balance and profitability within the Greif portfolio and increase Greif’s exposure to US industrial and consumer end markets.

“Most importantly, Greif and Caraustar share the same dedication to providing industry-leading service to all customers.”

The deal is expected to offer value creation through substantial cost synergies and performance improvements, as well as increase the presence of Greif’s paper packaging product offering.

Financing for the transaction is offered by various investors, including Wells Fargo Bank, National Association, Goldman Sachs Bank USA, and JP Morgan Chase Bank.