Türkiye’s introduction of anti‑dumping duties on imported packaging film marks a significant shift in the packaging sector, aimed at protecting domestic manufacturers from unfair pricing.

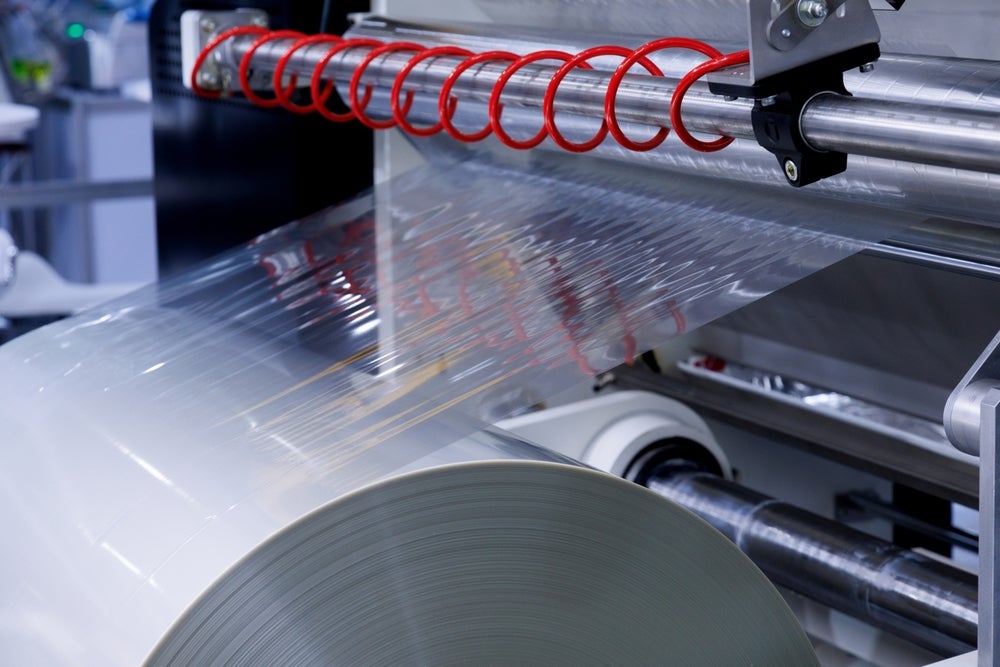

The measures apply to Biaxially Oriented Polypropylene (BOPP) and similar packaging films, widely used in food, consumer goods, and label production.

Duties vary by origin and firm

New tariffs range from 12.85% to 62.94% on packaging film imports from China and Egypt, depending on the company’s pricing practices.

Russian imports face a uniform 47.14% duty. These steps follow an investigation by Türkiye’s Ministry of Trade, which found evidence of undervalued imports harming local producers.

Understanding bopp packaging film

BOPP film is a versatile, cost‑effective plastic used extensively in packaging due to its clarity, strength and printability. Applications include snack wrappers, adhesive tapes and decorative packaging.

By wartime stretching of polypropylene in two directions, BOPP offers lightweight moisture resistance—key features for food safety and shelf appeal.

Industry context and trade implication

Türkiye’s move mirrors broader trends in trade protection: governments imposing antidumping duties to support local production.

According to international trade guides, these remedies are common in sectors like steel, textiles and packaging when foreign competitors undercut domestic prices.

For downstream users—such as packagers of food, cosmetics and pharmaceuticals—heightened costs for imported packaging film may lead to seeking alternatives from Turkish suppliers or adjusting material use.

Major global manufacturers may revise sourcing strategies in response to region‑specific duties and push for long‑term contracts to offset price volatility.

Packaging market outlook

Analysts expect Türkiye’s anti‑dumping tariffs to reshuffle global packaging supply chains. Exporters from China, Egypt and Russia may now consider targeting alternative markets or renegotiating prices.

Domestic Turkish producers stand to increase output, possibly investing in capacity expansion or downstream processing.

Observers note the European Union and United States also maintain anti‑dumping regimes for similar film products—Turkey’s latest action aligns with a global shift towards trade measures aimed at preserving national packaging industries.

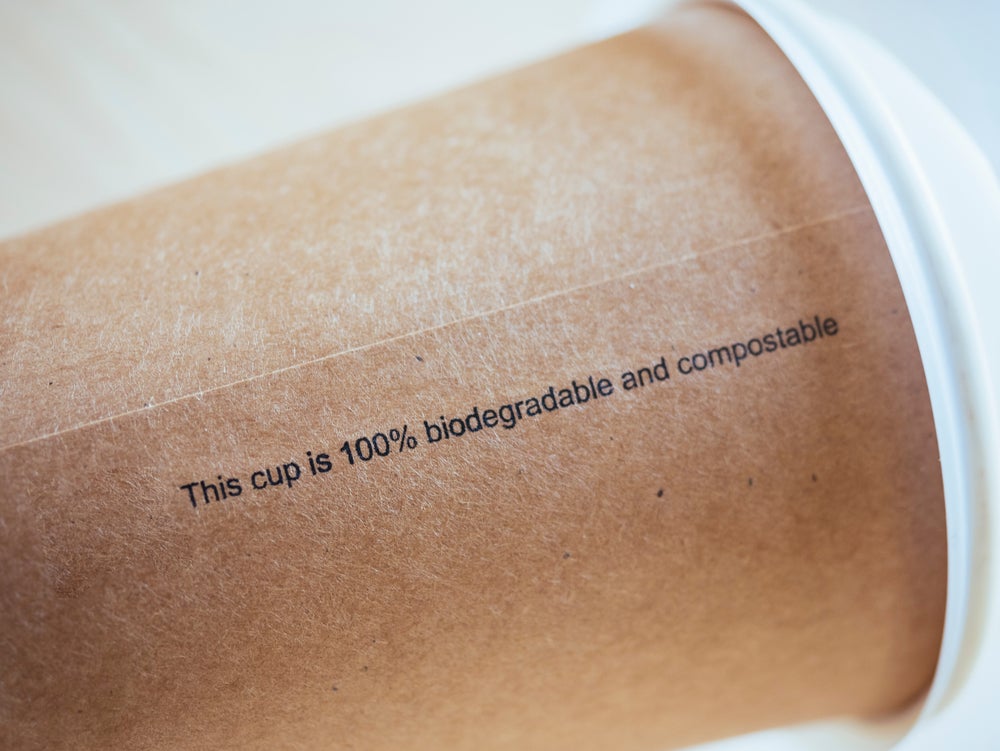

As interest in sustainable and high‑barrier packaging grows, the imposition of duties may drive innovation in domestic film production. Turkish companies could leverage enhanced margins to invest in biodegradable or recycled film technologies.

Meanwhile, brands and converters will weigh cost increases against regulatory stability and supply security.

The packaging sector will monitor follow‑up actions from Türkiye, including potential appeals to the World Trade Organization or adjustments in EU‑Turkey trade relations.

With similar duties expiring on other products later this year, scrutiny will remain on Ankara’s trade policy stance in the wider packaging materials market.