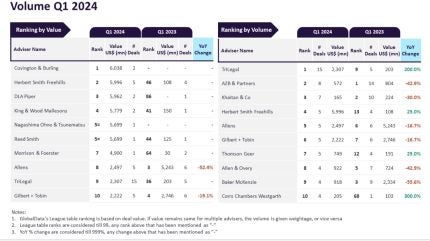

Covington & Burling and TriLegal emerged as the top mergers and acquisitions (M&A) advisers in the Asia-Pacific region for the first quarter (Q1) of 2024, according to a report by GlobalData, a leading data and analytics company.

Covington & Burling secured the top spot by deal value, advising on $6bn worth of mergers and acquisitions. This success can be largely attributed to their involvement in the high-profile $5.7bn Renesas-Altium deal.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

TriLegal, on the other hand, dominated by deal volume, advising on a total of 15 transactions in Q1.

Aurojyoti Bose, Lead Analyst at GlobalData, commented: “TriLegal was the only legal adviser with double-digit deal volume during Q1 2024 and apart from leading by volume, it also occupied the ninth position by value during the quarter.

“Meanwhile, Covington & Burling topped the table in terms of value by advising on only two deals. The involvement in $5.7 billion Renesas–Altium M&A deal played a pivotal role for Covington & Burling in securing the top position by value.”

Following Covington & Burling in the value rankings were Herbert Smith Freehills in second with $6bn worth of deals, followed by DLA Piper with $6bn, King & Wood Mallesons with $5.8bn and Nagashima Ohno & Tsunematsu with $5.7bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor deal volume, AZB & Partners came in second with eight deals, followed by Khaitan & Co (seven deals), Herbert Smith Freehills (five deals), and Allens (five deals).