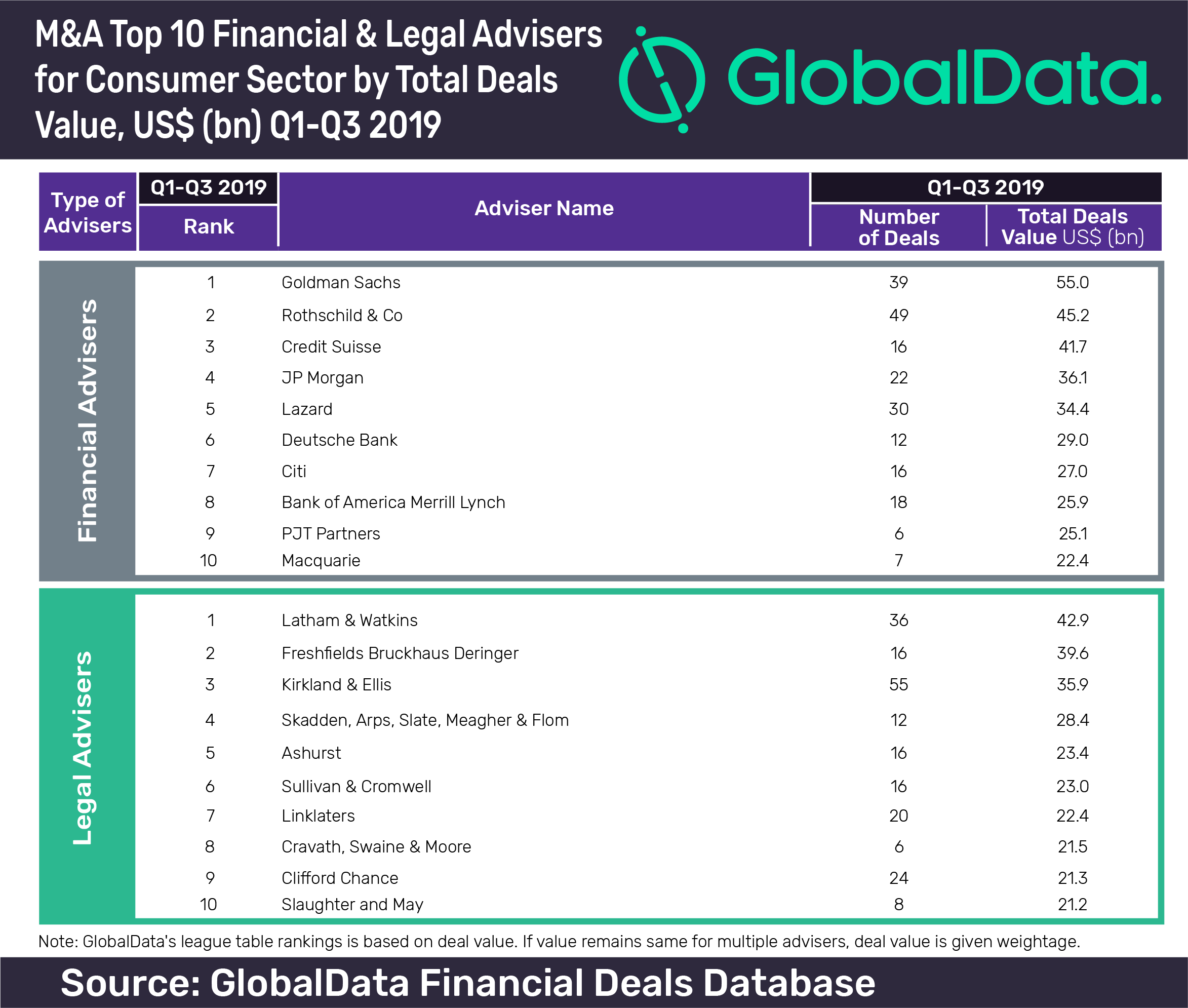

Goldman Sachs was the leading financial adviser globally for mergers and acquisitions (M&A) in Q1-Q3 2019 in the consumer sector, according to GlobalData.

The investment bank advised on 39 deals worth a combined $55.0bn, including the big ticket deal, Merlin Entertainments’ acquisition by KIRKBI Invest, Blackstone and Canada Pension Plan Investment Board (CPPIB) for $7.56bn.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

It figured in the first position in GlobalData’s Q1-Q3 2019 ranking of top 20 financial advisers for global mergers and acquisitions.

GlobalData has published a top ten league table of financial advisers ranked according to the value of announced M&A deals globally. If the value remains the same for multiple advisers, deal volume is given weightage.

Rothschild & Co trailed Goldman Sachs, clocking 49 deals worth $45.2bn. With 16 deals valued at $41.7bn, Credit Suisse figured at third position.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe consumer sector saw a 7.97% reduction in deal value from $ 246.00bn in Q1-Q3 2018 to $ 226.39bn in Q1-Q3 2019. On the contrary, deal volumes grew by 35.25 from 2,891 in Q1-Q3 2018 to 3,910 in Q1-Q3 2019.

UK-based law firm Latham & Watkins led the chart of top ten legal advisers in terms of value. It provided legal services for 36 deals worth a combined $42.9bn. Freshfields Bruckhaus Deringer advised on 16 deals worth $39.6bn. In the global league table of top 20 legal advisers for Q1-Q3 2019, Wachtell, Lipton, Rosen & Katz topped the list. Latham & Watkins stood at eighth position while Kirkland & Ellis figured at the second position.

GlobalData Financial Deals Analyst Nagarjun Sura said: “Latham & Watkins emerged as the top legal adviser in the consumer sector, mainly driven by its involvement in a big-ticket deal – Eldorado Resorts acquisition of Caesars Entertainment for US$17.3bn. With respect to deal value, only Goldman Sachs was able to cross US$50bn mark and topped the financial adviser category.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.