Sonoco, a global packaging company, has posted a generally accepted accounting principles (GAAP) net income of $54.4m for the first quarter (Q1) ending 30 March 2025, a 16.5% dip from the $65.2m recorded in Q1 2024.

It reported a 22.7% year-over-year rise in adjusted net income, totalling $137m, and adjusted diluted earnings per share of $1.38.

In the first quarter, the effective tax rates on GAAP net income and adjusted net income attributable to Sonoco - excluding discontinued operations - were 30.9% and 25.7%, respectively.

This contrasts with rates of 18.6% and 26.2%, respectively, during the same period in 2024.

In the latest quarter, the company achieved record net sales of $1.7bn, marking a 30.6% increase compared to the same period in the previous year.

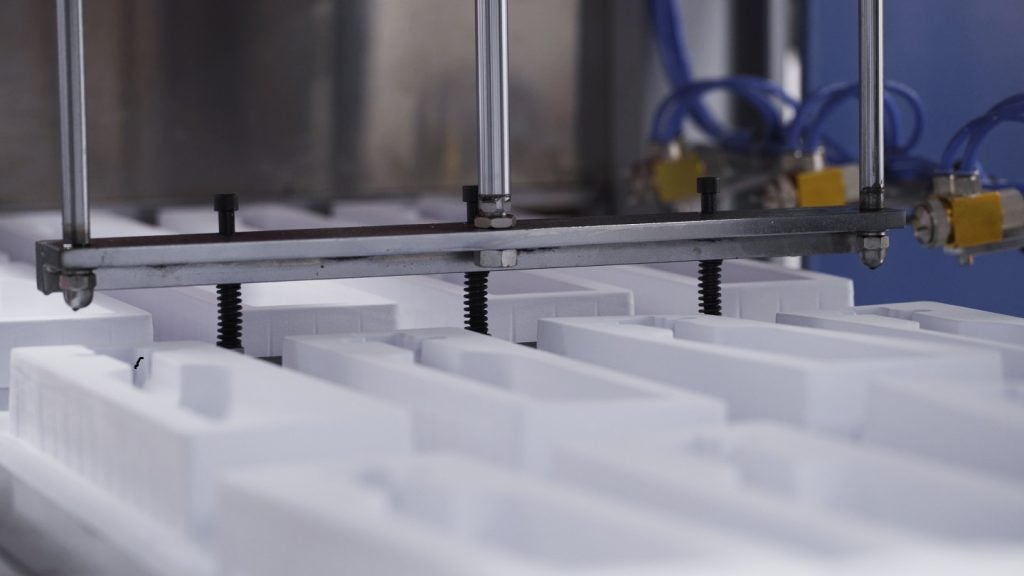

The company attributed this growth to its Metal Packaging Europe, Middle East and Africa (EMEA) business following the 4 December 2024 acquisition of Titan Holdings I (Eviosys).

Furthermore, price increases were partly counterbalanced by the loss of revenue from the sale of the Protexic Solutions business, the closure of two manufacturing sites in China, and adverse effects from foreign currency exchange rates.

Overall, changes in sales volumes had a limited effect, as robust growth in consumer packaging volumes was balanced by year-on-year declines in volumes within the Industrial Paper Packaging segment.

The company reported record first-quarter adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $338m, marking a 38% rise compared to the same period last year.

Sonoco has reiterated its full-year 2025 outlook, anticipating a 20% increase in adjusted net income and a 30% rise in adjusted EBITDA.

Sonoco recently completed the $1.8bn sale of its Thermoformed and Flexibles packaging segment to TOPPAN Holdings and used $1.5bn of the after-tax proceeds to reduce its debt significantly.

In Q1 2025, the company directed $92m in net capital towards growth and productivity projects.

The company realised $17m in favourable productivity improvements from procurement savings, production efficiencies, and fixed cost reduction efforts.

Sonoco president and CEO Howard Coker said: “Our first-quarter results demonstrated the strength of the new Sonoco as our global team achieved record top-line and adjusted EBITDA performance, growing 31% and 38%, respectively, while adjusted earnings per share rose 23% despite higher-than-expected interest expense, taxes and the negative impact of currency exchange rates.

“Consumer Packaging segment sales grew 83% and adjusted EBITDA jumped 127%. We completed the first phase of the integration of Eviosys as it has been rebranded Sonoco Metal Packaging EMEA and we drove strong synergies across the global Metal Packaging enterprise."